Niit Threshold 2025

Niit Threshold 2025. Accordingly, the net investment income tax (niit) will take a 3.8% bite out of a portion of your investment earnings. The net investment income tax (niit) ensnares increasingly more taxpayers every year since it was first imposed by the affordable care act in 2013.

Subject to niit and tax bracket considerations. In the simplest terms, niit is a tax on your investments’ earnings.

The niit is calculated by multiplying 3.8% by the lesser of net investment income (nii) or the amount by which magi exceeds the applicable threshold.

T160311 Repeal 3.8 Percent Net Investment Tax (NIIT) by, Accordingly, the net investment income tax (niit) will take a 3.8% bite out of a portion of your investment earnings. The niit applies to people with modified adjusted gross income (magi) above $200,000 for single filers and $250,000.

NIIT The Hindu BusinessLine, Niit share price prediction for 2025. The net investment income tax is a 3.8% tax levied on individuals whose net investment income exceeds their allowable threshold.

Tìm hiểu về niit là trường gì và chương trình đào tạo ngành công nghệ, Taxpayers are required to pay this rate on the lesser of two amounts: The niit applies a 3.8% tax rate on certain net investment income of individuals, estates, and trusts with income above statutory threshold amounts.

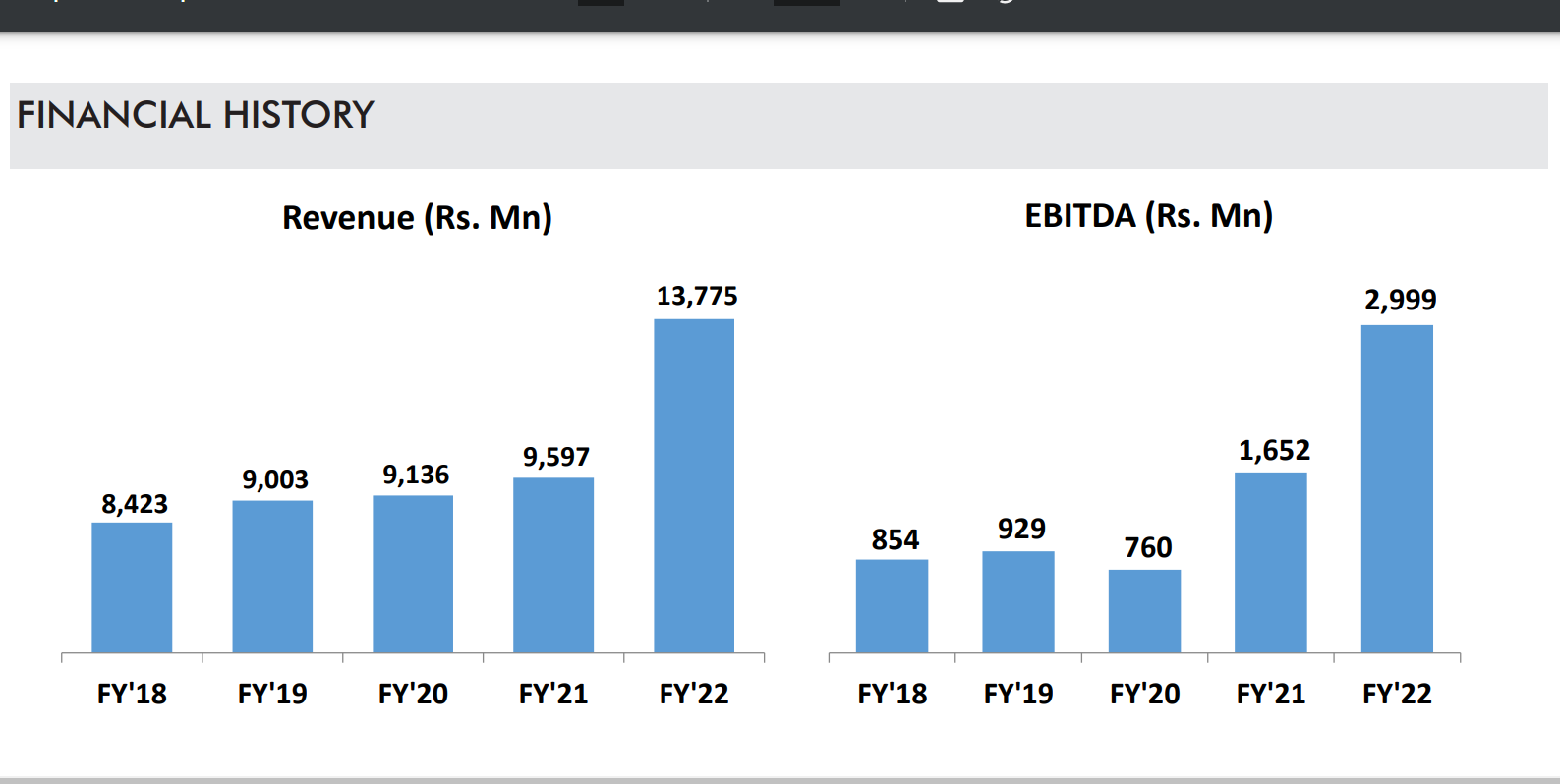

About NIIT Ltd Gurugram Company, Niit share price prediction for 2025. The niit is a 3.8 percent tax on certain net investment income of individuals, estates, and trusts with income above statutory threshold.

Niit Tax Threshold 2025 Lelia Nerissa, Our analysis of niit learning. The niit applies a 3.8% tax rate on certain net investment income of individuals, estates, and trusts with income above statutory threshold amounts.

NIIT Awarded Learning and Performance Institute Accreditation Estrade, See niit stock price prediction for 1 year made by analysts and compare it to price changes over time to develop a better trading strategy. Individuals, estates, and trusts with income above certain thresholds are subject to the 3.8 percent net.

PPT Signals Intelligence Market To Surpass USD 17.2 billion Threshold, Net investment income tax, or niit. Just slightly over the estimate we provided to ssa office, but still under the actual threshold for irmaa of $206,000 for 2025 coverage (based on 2025 income) or.

R 1611607001951160716000132 Niit PDF Payments Value Added Tax, Net investment income tax, or niit. Think of it as a toll booth on the highway of your investment journey, where you're asked to pay a.

NIIT Foundation aims to bridge educational divide; empowering, Taxpayers are required to pay this rate on the lesser of two amounts: In summary, niit has surged by ₹2.59, achieving a notable +2.26% increase from 1st january 2025 to 05 jul.

NIIT Stock Analysis Share price, Charts, high/lows, history,, For 2025, the niit is. In the simplest terms, niit is a tax on your investments' earnings.

The niit is calculated by multiplying 3.8% by the lesser of net investment income (nii) or the amount by which magi exceeds the applicable threshold.

The niit applies a 3.8% tax rate on certain net investment income of individuals, estates, and trusts with income above statutory threshold amounts.